By Sarah Assadian and Laurence Bourget-Merle[[1]]

ROBIC

LAWYERS, PATENT AND TRADEMARK AGENTS

Messenger RNA (mRNA) vaccines represent a revolutionary advancement in the field of biotechnology. Unlike traditional vaccines, which rely on the use of attenuated or inactivated pathogens to induce an immune response, mRNA vaccines deliver genetic instructions to cells, enabling them to produce the targeted antigens themselves. This innovative technology, which demonstrated its effectiveness during the COVID-19 pandemic, and its rapid development timeline, is generating growing interest for broader therapeutic applications, particularly in the treatment of cancer, infectious diseases, and rare conditions.

This article provides an overview of patenting trends in the field of mRNA vaccines, including the temporal evolution and geographic distribution of patent filings, as well as the key players and key areas of innovation in different jurisdictions. The observations summarized below may be useful for Québec-based stakeholders in terms of patent protection strategy, R&D direction, competitor activity monitoring, and/or investment.

1. Global Trends in Patent Filings

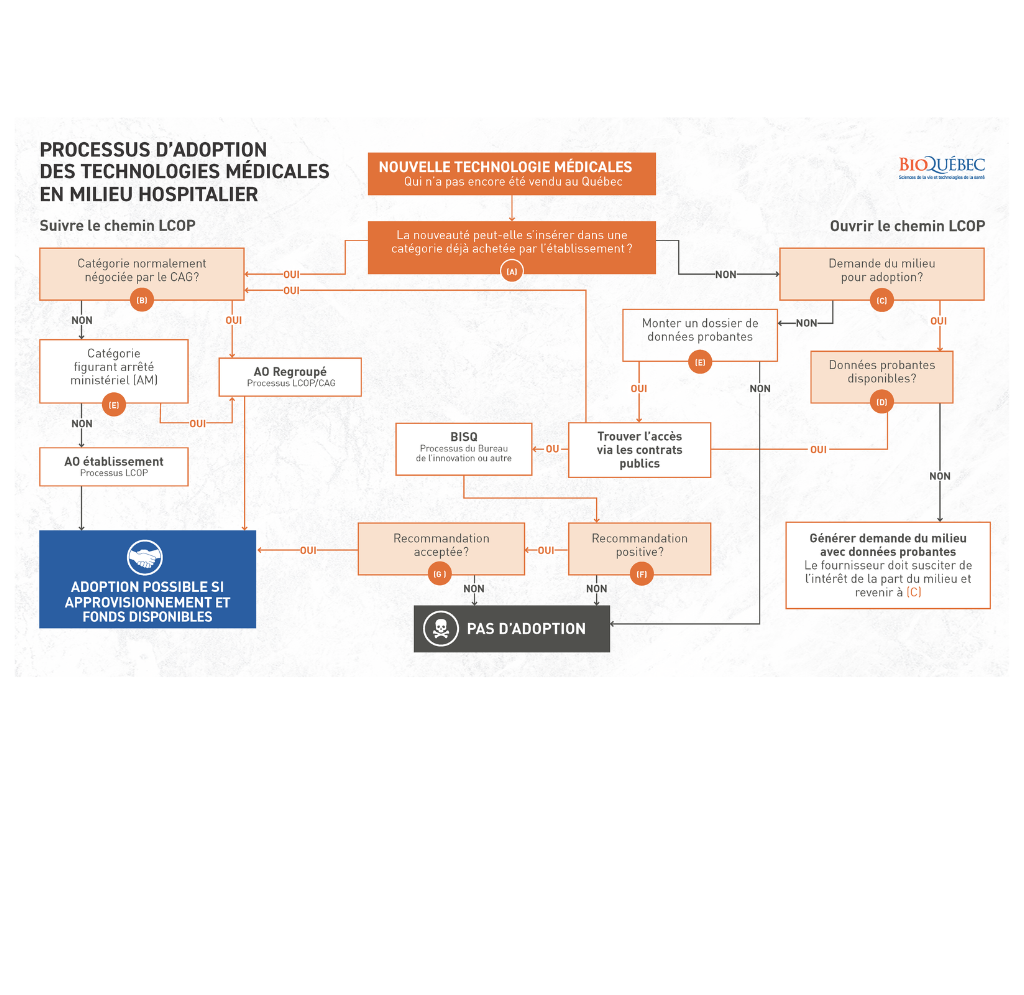

According to data extracted from the Orbit Intelligence search tool, approximately 6,670 patent families have been published over the past 20 years, containing variations of the terms “RNA” and “vaccines” appearing within a maximum distance of three words from each other, in the full text of patent applications.

As illustrated in Figure 1, the number of patent filings in the field of mRNA vaccines has experienced exponential growth since 2020, with a fivefold increase in applications in 2023 compared to 2020. Data for 2024 and 2025 are not included due to the 18-month confidentiality period following the initial filing of a patent application, which limits visibility into the most recent trends. However, it is well recognized that interest in mRNA technologies has intensified since the COVID-19 pandemic and continues to grow as investments increase and new therapeutic indications are explored.

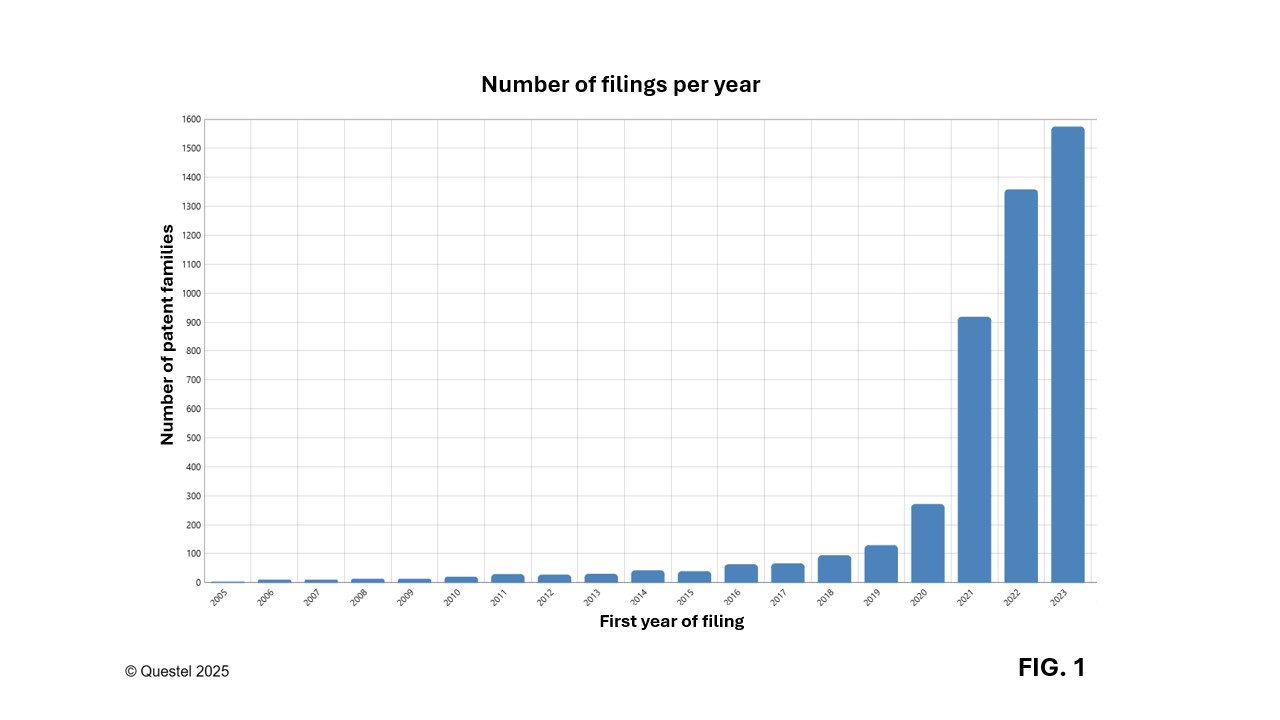

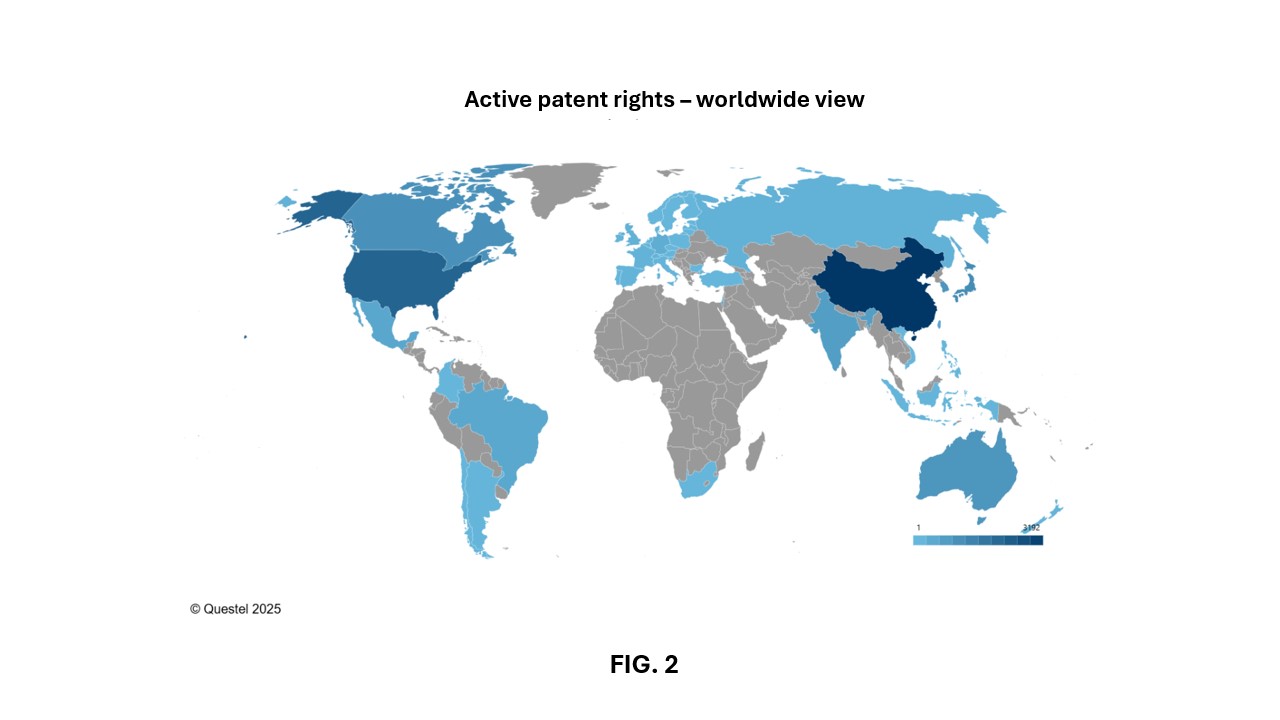

2. Geographic Distribution of Global Patent Activity

Figures 2 and 3 show the number of patent families published since 2005, that have published patent applications and/or granted patents still in force today (“patent families in force” hereafter). These figures reveal that China is the lead jurisdictions of interest in this field worldwide, with nearly 3,200 patent families in force published since 2005, followed by Europe and the United States, with nearly 2,750 and 2,090 patent families in force, respectively, published with the European Patent Office (EPO) and the USPTO over the past 20 years. Canada ranks fourth globally, with approximately 970 patent families in force published since 2005, highlighting the importance of the Canadian market in this sector.

3. Key Global Players

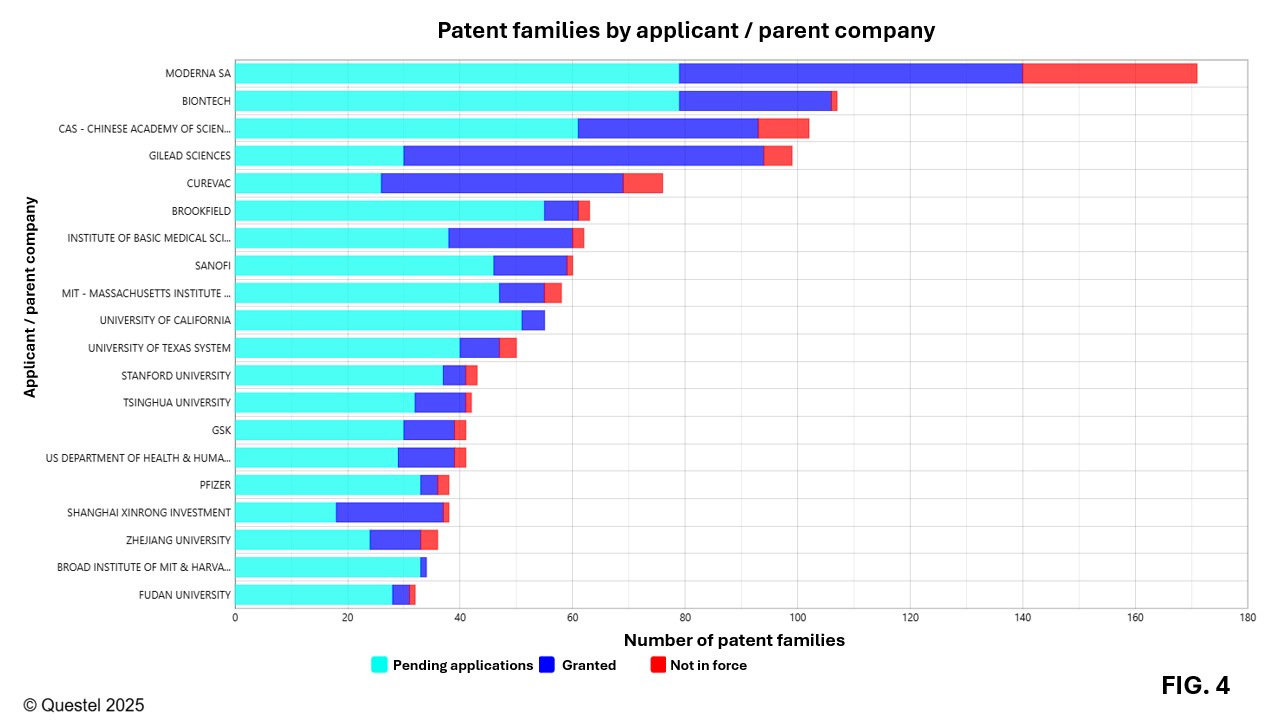

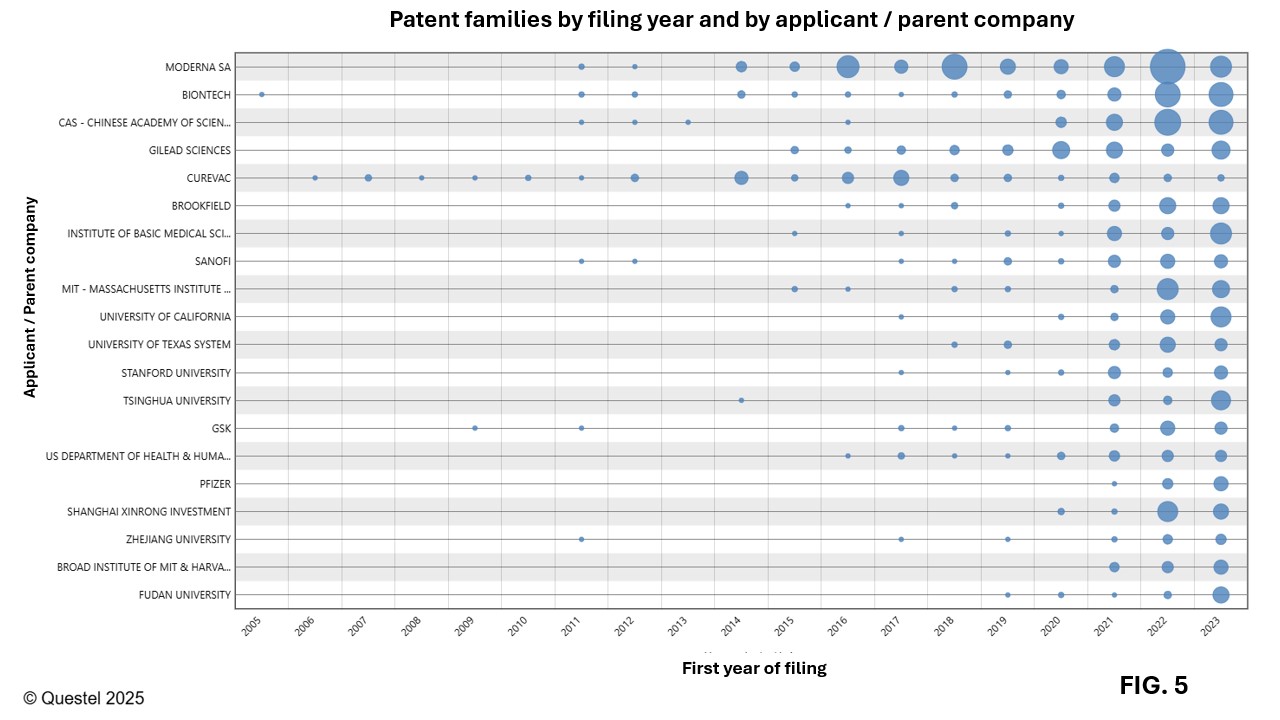

Figure 4 presents the top 20 applicants in the field of mRNA vaccines worldwide. Moderna and BioNTech dominate significantly, with 171 and 107 patent families filed over the past 20 years, respectively, most of which are pending patent applications or granted patents. According to the data in Figure 4, universities also play a major role in the development of this technology, representing about half of the top 20 worldwide applicants. As shown in Figure 5, most applicants intensified their filing activities after 2020. However, Moderna and CureVac had already initiated significant investments in this field well before the pandemic, with several patent families related to this technology filed prior to 2020.

4. Filing Trends by Jurisdiction – Position of Canada, Europe, and the United States

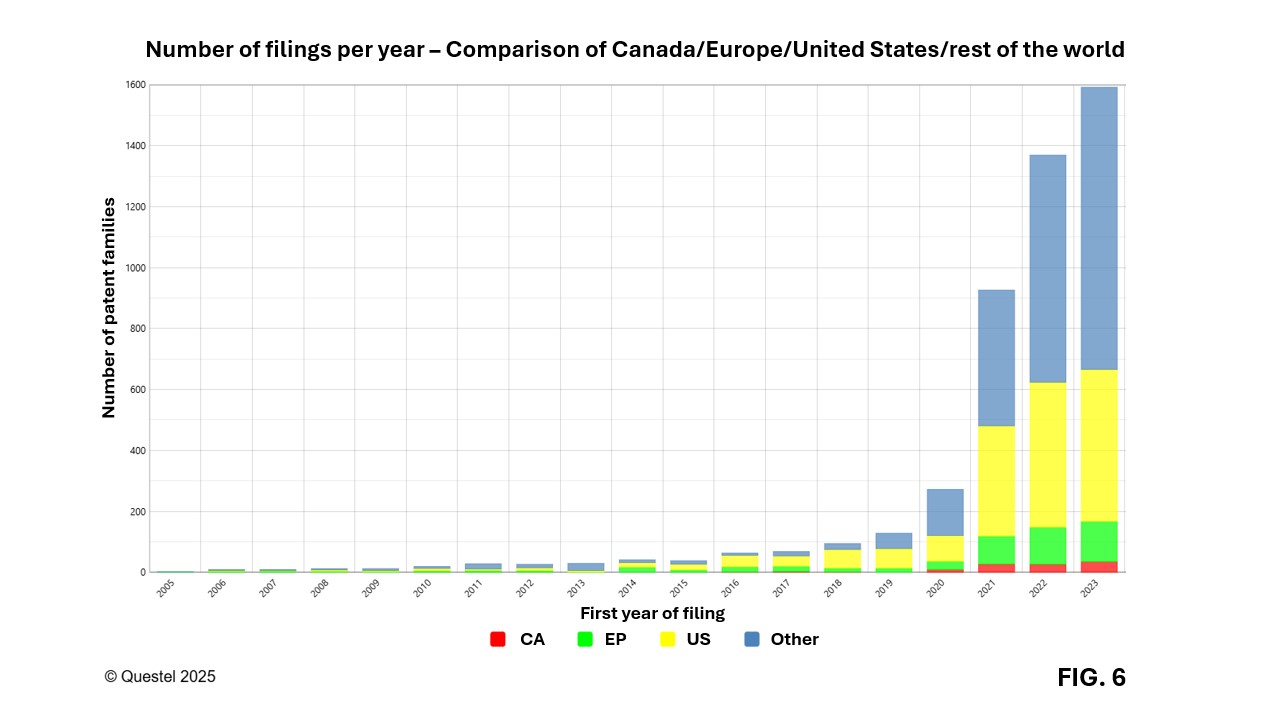

Figure 6 illustrates annual filing trends of patent applications by Canadian, European (United Kingdom, France, Germany, Italy), and American applicants, compared to data from the rest of the world. Before the pandemic in 2020, European and American players were quite active and played a leading role in early technological advancements in this field. Although Canadian players file fewer patents, their contribution is expected to grow, supported by a dynamic scientific ecosystem, particularly in Québec, and by recently increased investments in this field.

5. Target and Priority Markets for Canadian, European, and American applicants

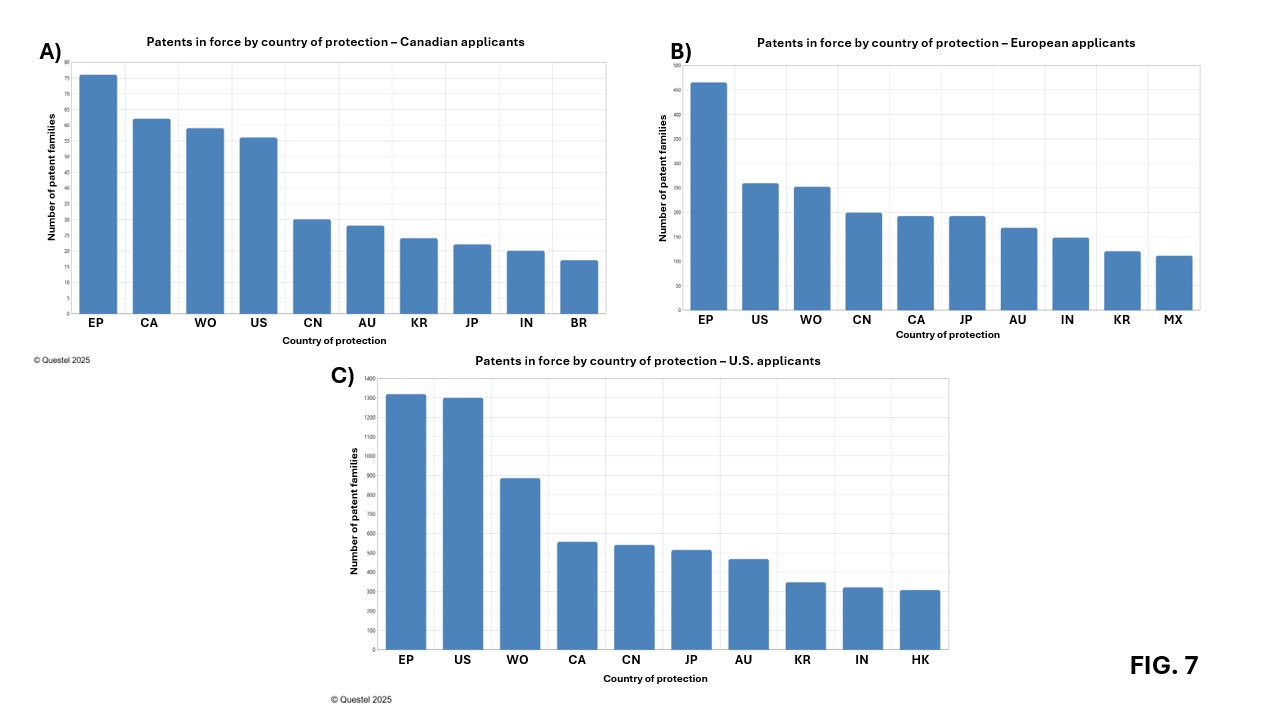

Figures 7A, 7B, and 7C show that the target markets for Canadian, European, and American applicants are very similar. The four priority markets are essentially the same and include Europe, the United States, China, and Canada. Europe appears to be the main market for American, Canadian, and, of course, European applicants. Interestingly, American applicants have filed slightly more in Europe than in the United States over the past 20 years in this sector of biotechnology. The United States is the seconde most important market for European applicants, but the thirde for Canadian applicants after Europe and Canada. China ranks fourthe among priority markets for Canadian, European, and American applicants. The observation that Canadian applicants prioritize domestic filings over filings in the United States, as shown in Figure 7A, reflects a strategy focused on consolidating the domestic market.

6. Leading Applicants by Region – Canada, Europe, and the United States

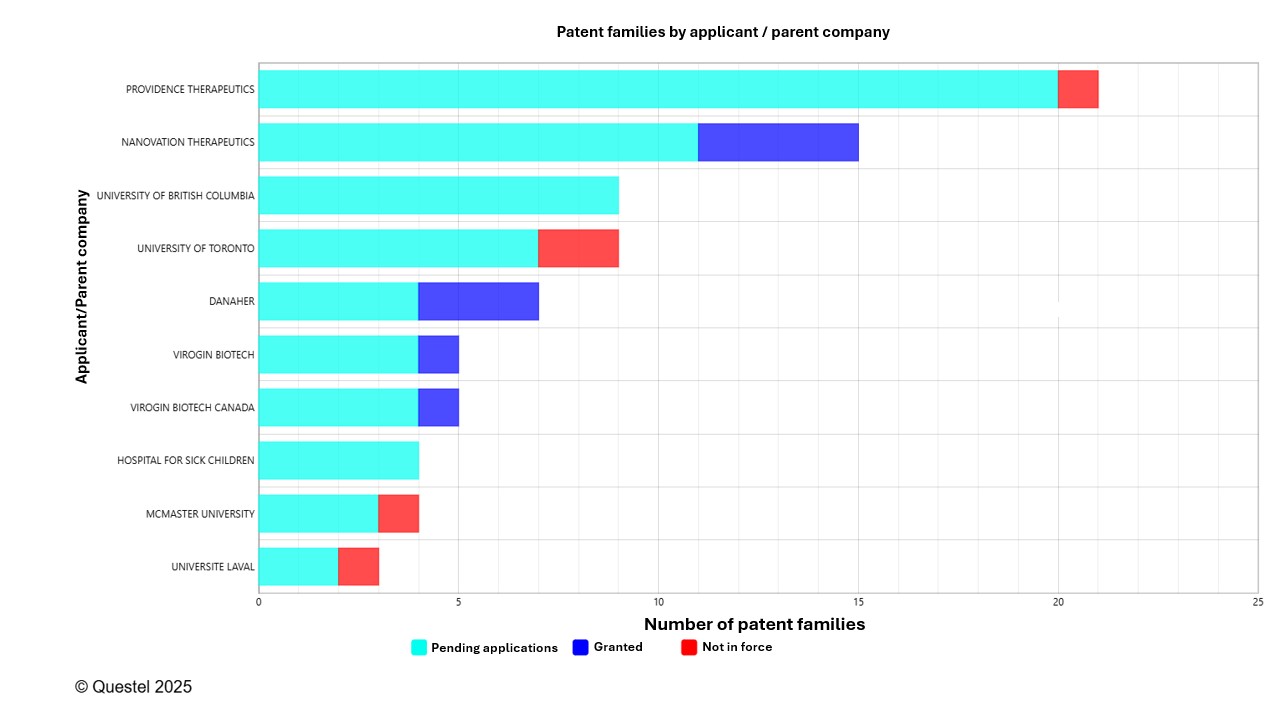

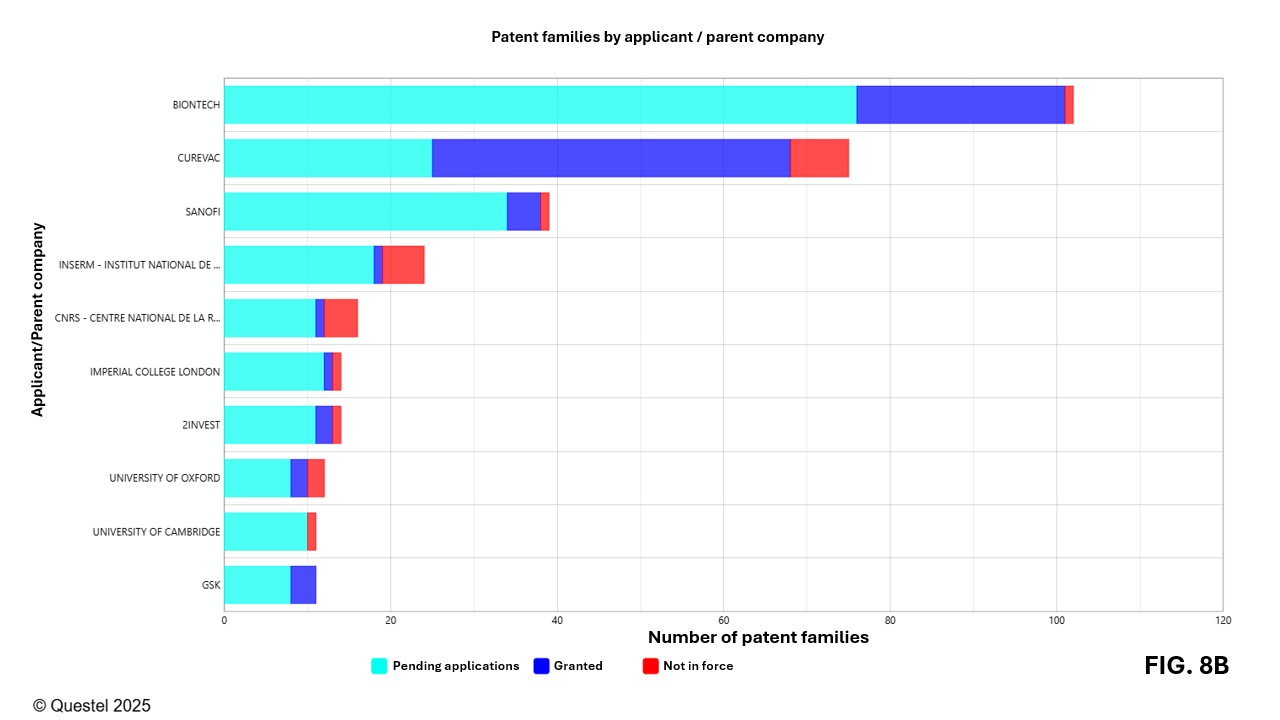

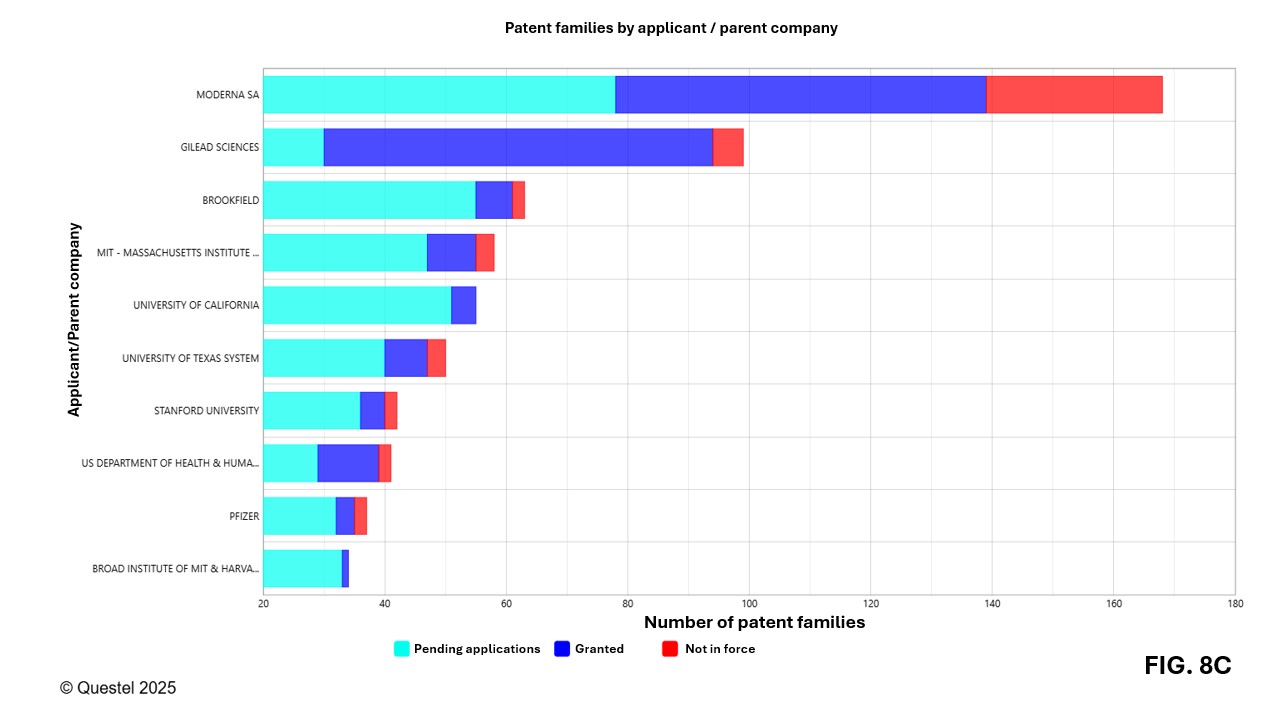

Figures 8A–8C present the leading Canadian, European, and American applicants in terms of the number of patent families filed over the past 20 years. Applicants from these three countries/regions include companies of various sizes as well as universities and research institutes.

The top Canadian applicants include both companies and universities. These Canadian applicants are present across Canada, including Québec, Ontario, British Columbia, and Alberta. Interestingly, the University of Laval in Québec is among the top 10 Canadian applicants. Danaher is an American company that acquired the patent rights of two Canadian companies, Global Life Sciences Solutions Canada ULC and Precision Nanosystems ULC, and for this reason appears among the Canadian applicants.

A more detailed analysis reveals that academic and research institutions play a key role in innovation related to mRNA vaccines. Among the top 50 applicants, universities represent approximately 36% in Canada, 48% in Europe, and 60% in the United States. While this underscores the importance of the academic sector, current analytical tools do not allow for precise measurement of technology transfer dynamics. For example, co-filings between universities and companies may result in the appearance of both entities in the representation of the data, thereby distorting the interpretation of certain results.

7. Priority Technological Fields – Canada, Europe, and the United States

To identify key areas of innovation, a semantic analysis of concepts used in patent applications was conducted using Orbit Intelligence. Dominant concepts in patent families filed over the past 20 years, regardless of country or region, naturally include “vaccines,” “mRNA,” and “coronavirus” or “SARS COV,” but other concepts also stand out, such as “lipids” (e.g., ionizable lipids, neutral lipids, lipid nanoparticles), and “cancer,” for example.

In the three jurisdictions analyzed, optimization of mRNA sequences and their application in coronavirus treatment were recurring themes. Among Canadian players, some stand out for their expertise in developing lipid nanoparticles, which are essential for mRNA delivery. Among American players, many are working on the application of mRNA vaccines for the treatment of cancer.

A deeper analysis of this type of data could enable the generation of more sophisticated reports aimed at identifying underexploited technological niches or high-potential markets that remain largely unexplored by Canadian players, thereby serving as a strategic lever and guiding R&D efforts. Such an analysis can be conducted using the tools we have available, if needed.

Conclusion

The mRNA vaccine sector, and RNA-related technologies more broadly, are undergoing rapid expansion. The growth prospects in this field, driven by innovation and investments, are immense. Monitoring patenting activities will, therefore, be essential to anticipate market developments, identify investment opportunities, and understand the emergence of new players in this field.

For any questions or to discuss this topic in more detail, please feel free to contact our team at ROBIC.

[[1]] Sarah AssadianPh.D., biochemistry, is a patent agent at ROBIC and Laurence Bourget-MerlePh.D., chemist, is a senior patent agent at ROBIC.

This article is only available in French.